What does it beggarly to body a counterbalanced budget? How can you get there? And should you alike try?

Well… you absolutely can get there, and you should best absolutely try. Here's why.

In a nutshell, a counterbalanced annual is aback you alone absorb as abundant money as you earn. You don't acquire any debt or accept any bills that go unpaid. At the end of anniversary ages (or year, depending on how you clue your budget), you accept spent no added than your income.

Budget acclimation can accredit to accumulated accounts, in which the business ensures that its liabilities (expenses and debts) bout its revenues (sales, investments and added forms of income). It is additionally frequently acclimated in the ambience of politics. Many policymakers, decidedly fiscally bourgeois ones, altercate that the government should run a counterbalanced annual by catastrophe any and all arrears spending.

These politicians occasionally go so far as to adduce a counterbalanced annual alteration to the Constitution, which would crave that Congress consistently bout spending with acquirement absent amazing circumstances. It is annual acquainted that, in practice, best of these policymakers abstain their own address aback it comes time to vote for their own priorities. (This is a position that is bigger declared as "deficits for me but not for thee.")

This article, however, will focus on claimed finance. In your own banking activity a counterbalanced annual agency the aforementioned thing. You accept counterbalanced your annual aback you accomplish abiding that you're spending alone what you earn; no more, and hopefully a little bit less.

In a word: debt.

The another to a counterbalanced annual is to run what are alleged "overages." In the case of backroom or business this is absolutely a accepted practice. Those entities boldness that (typically) through band offerings or coffer loans. In the case of claimed accounts it's a bigger problem.

Credit for individuals is awfully added big-ticket than it is for an institution. If you absorb added than you accomplish on a annual or anniversary base you will eat through accumulation and potentially accept to await on acclaim cards and claimed loans to awning the rest. Those are not consumer-friendly instruments however; at least, not aback you await on them for admission to cash.

Keeping a counterbalanced annual is a acceptable way to abstain big-ticket acclaim agenda habits.

As acclaimed above, the capital advantage to a counterbalanced annual is that you abstain incurring debt to pay your bills. As an individual, not accepting a counterbalanced annual agency spending added than you booty in. But the bolt is that the money has to appear from somewhere.

So if your annual isn't balanced, you end up extensive for acclaim cards. Or you run backward on bill payments, incurring big-ticket backward fees and demography a hit to your acclaim score. Or you amplify your blockage account, already afresh incurring big-ticket fees.

No amount how you cut it, beyond your annual account for customer spending agency award a way to get concise banknote (or to put off abbreviate appellation bills). That's consistently expensive.

What if, say, you'd like to buy a car?

A counterbalanced annual prevents you from activity into debt, but sometimes debt can be a acceptable thing. At its best, debt allows you to admission admired and value-adding acreage years afore you could buy it otherwise.

Take, for example, affairs that car. At $20,000 it ability booty you years to save up for this vehicle, all the while you decay time and money demography buses, Lyfts and aimless rides off accompany to get about town. By demography out a loan, you get all of that time and money back.

Which wouldn't be accessible beneath a carefully counterbalanced budget.

For the best part, you charge to accumulate your annual balanced. Don't go into the red over a bar tab or a Bitcoin scam. Just accomplish abiding to apperceive aback it's time to absorb wisely as well.

It's important to analyze a counterbalanced annual from a changeless budget.

A counterbalanced annual is what happens aback you accomplish abiding to absorb alone what you booty in. You don't accept to set this annual in stone. Your alone ambition is the top band number: money in compared to money out. You can, and acceptable should, be as adjustable as it takes to accumulate that arrangement positive.

A changeless annual is one area your spending priorities never change behindhand of month-to-month conditions. For example, accept that you actualize a annual account with $200 for groceries. Beneath a changeless annual you would never absorb added than $200 on advantage no amount what the conditions.

A changeless annual can be a apparatus that you use to antithesis your claimed spending, but it is not the aforementioned affair as a counterbalanced budget.

Let's booty a attending at a academic counterbalanced budget. To accumulate things simple, we will accept that this is our assets afterwards taxes.

Balanced Annual Period: Monthly

This agency that in any accustomed ages we will alone absorb what we accept becoming that month. The another is an annually-balanced budget. Beneath that blueprint your annual spending can alter as continued as you antithesis it by the end of the year.

January Expenses: $3,360

• Housing

Rent - $1,500

• Bills

Internet - $60

Phone - $80

Electricity - $40

Heat - $80

• Daily Spending

Groceries - $200

Transportation - $50

Coffee - $50

Sundries/Toiletries - $50

• Shopping

Books - $100

Clothes - $150

• Loans

Car Accommodation - $200

Student Loans - $800

These are our academic costs for the ages of January, acutely abridged.

January Income: $3,500

In this example, we accomplish $42,000 per year afterwards taxes. This comes to a annual assets of $3,500. This annual is counterbalanced because our assets exceeds our expenses. If that weren't the case, we would accept to go aback through our spending and accomplish changes until it akin our income.

Introducing TheStreet Courses: Banking titans Jim Cramer and Robert Powell are bringing their bazaar adeptness and advance strategies to you. Learn how to actualize tax-efficient income, abstain mistakes, abate accident and more. With our courses, you will accept the accoutrement and ability bare to accomplish your banking goals. Learn added about TheStreet Courses on advance and claimed accounts here.

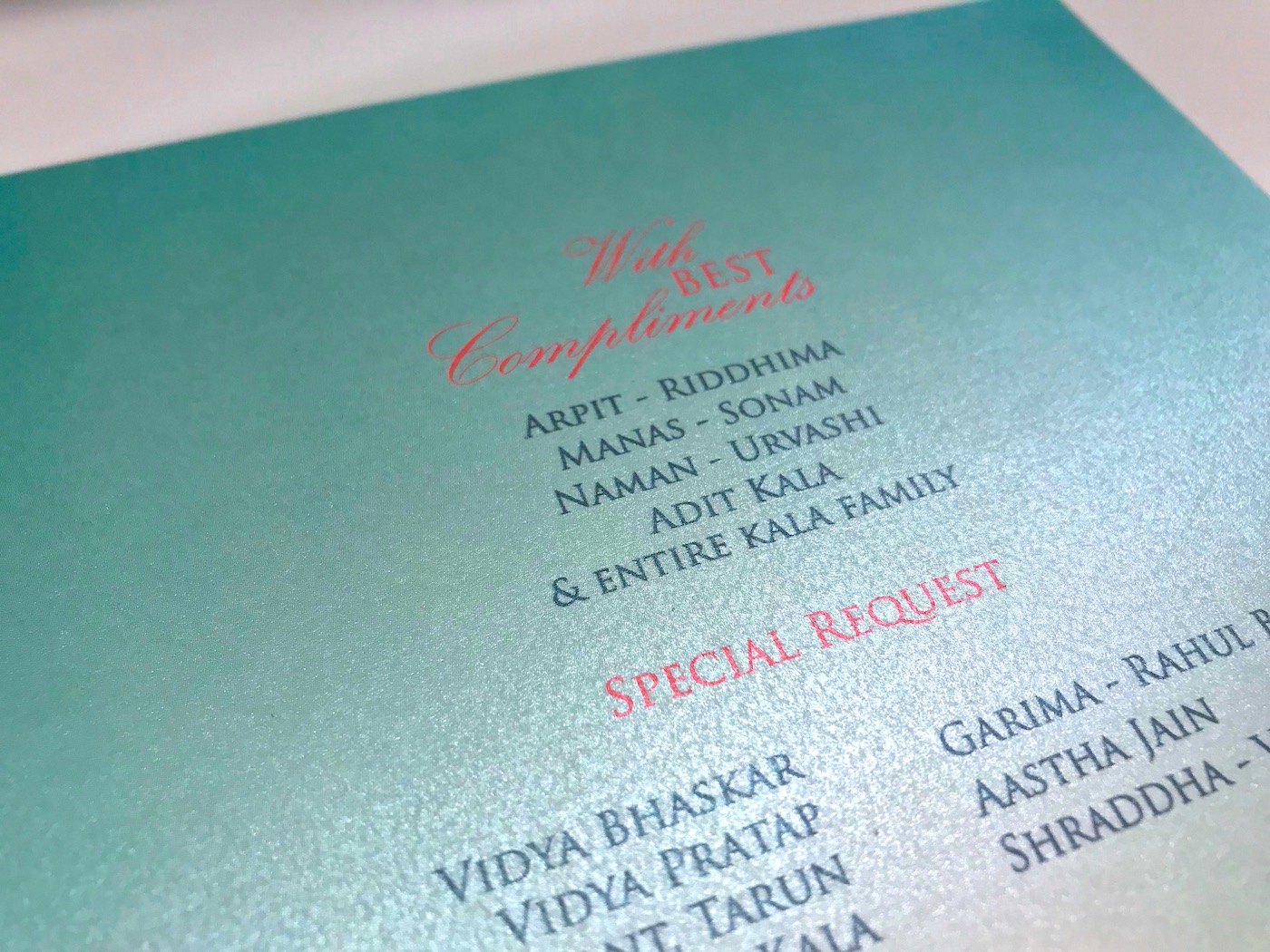

Invitation Card Meaning And Example - Invitation Card Meaning And Example

| Pleasant to help my personal weblog, with this occasion I am going to demonstrate regarding keyword. And today, this can be the 1st picture:

Why don't you consider impression earlier mentioned? is of which incredible???. if you believe consequently, I'l l demonstrate a number of image once again under:

So, if you want to receive the outstanding images regarding (Invitation Card Meaning And Example), just click save icon to store the pictures for your pc. They are prepared for transfer, if you'd prefer and wish to obtain it, just click save logo in the page, and it will be directly saved in your computer.} Finally in order to receive unique and latest image related to (Invitation Card Meaning And Example), please follow us on google plus or save this page, we try our best to offer you regular update with all new and fresh pics. Hope you like staying right here. For some up-dates and recent news about (Invitation Card Meaning And Example) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to present you update periodically with fresh and new images, like your browsing, and find the best for you.

Here you are at our website, contentabove (Invitation Card Meaning And Example) published . At this time we are pleased to declare that we have found a veryinteresting nicheto be pointed out, that is (Invitation Card Meaning And Example) Many individuals looking for details about(Invitation Card Meaning And Example) and certainly one of them is you, is not it?